- Easy personal budget template excel how to#

- Easy personal budget template excel full#

- Easy personal budget template excel download#

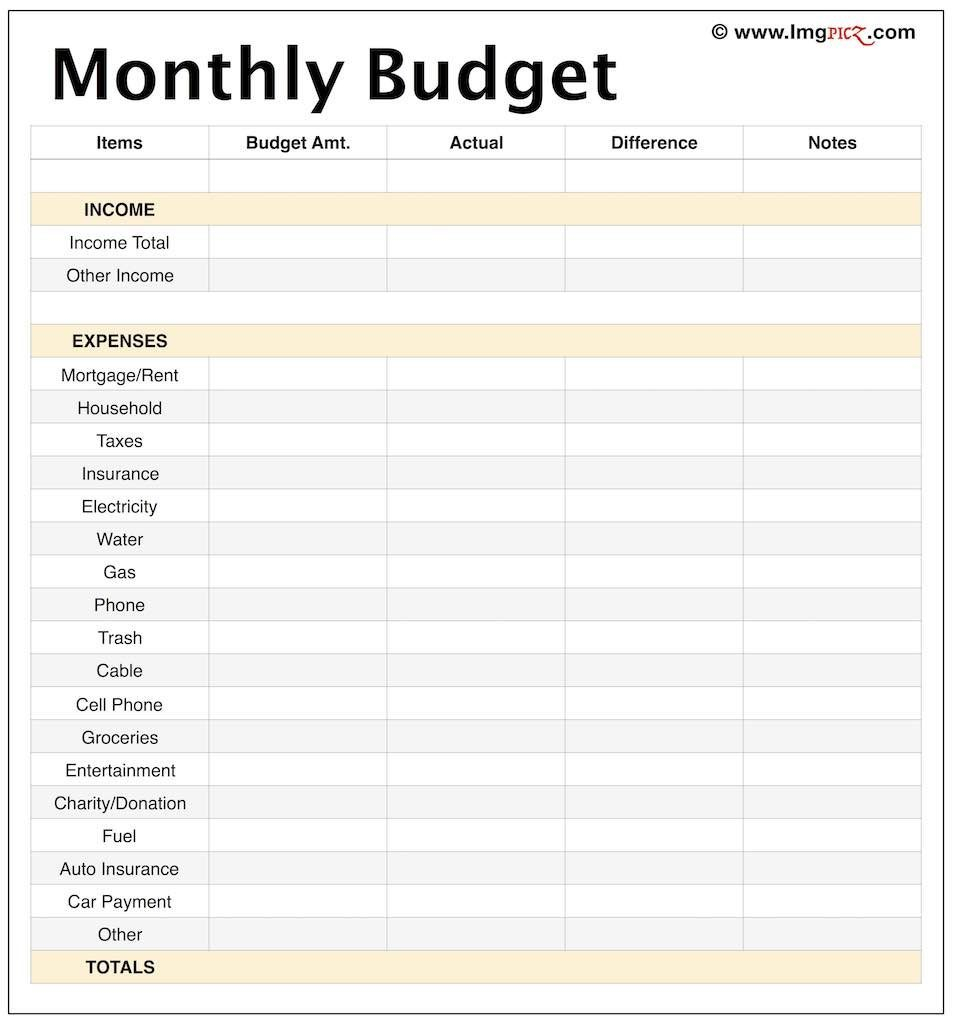

While you may be able to quickly determine how much money you’re bringing in every month, determining how much you spend is a much more detailed endeavor. Without actually adding up every cent you spend on a monthly basis, it’s difficult to know exactly how much you’re actually spending. Get an Accurate Idea of How Much You’re Spending Every Month Using a simple budget template can help make budgeting a cinchĤ. You may even consider trying out an account management tool that will remind you when you have a bill coming due soon.

Why waste money on late fees? An easy way to counter this is to set up your bill accounts on auto-pay so there’s no need to remember when to make the payment, and for what bill. The lower your credit score, the harder it will be for you to get approved for loans, including mortgages, car loans, and so forth.

Easy personal budget template excel full#

Sounds easier said than done, right? Perhaps, but paying your bills in full and on time every single month will not only help you avoid those sky-high interest rates on outstanding debt, it will also help keep your credit score healthy. If your employer offers a retirement savings plan, take advantage of it, and contribute to it as much as you can, especially if they match a percentage of your contribution. Have a portion of your paycheck automatically deposited into an account that you don’t have to touch. Whether they just didn’t have any money left over to do it, or simply ‘forgot’ to, many times the savings account is growing nothing but dust. Many people will come up with excuse after excuse as to why they didn’t – or couldn’t – put a certain amount of money aside each month into a savings account. Automatically Set Money Aside For Savings Once you’ve set this simple formula, you can break it down and elaborate on it as much as you want or need to.Ģ. If you get a negative number as a result, you know that you’ve got to cut back on certain expenses in order to keep the number in the positives. The difference between the two is what you have leftover to spend on leisure expenses, such as dining out, going out to the movies, going on vacation, etc. Start off using a simple formula – your take-home pay minus your expenses (including your mortgage/rent, car payments, utility bills, cable bills, and so forth). Although budgeting involves some level of mathematics, it doesn’t necessarily mean that you need to be a calculus professor in order to maintain a proper, working budget. You might hate math, which is huge reason why budgeting just hasn’t made it to your to-do list. If you’ve never budgeted before, and have procrastinated up to this point because you’re not sure how or where to start, the following 4 tips can help.

Easy personal budget template excel how to#

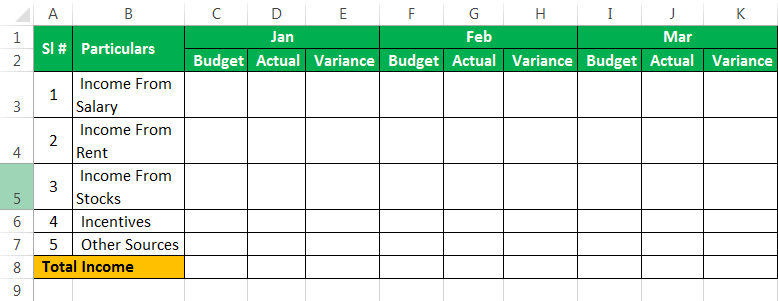

You may learn how to use Excel better in the process.Click below for the free budget template that matches your lifestyleīudgeting may not exactly be your favorite past-time, but it’s a necessary part of life in order to ensure that your finances are kept in order. If you use and customize any template for your personal budget, make sure you understand how it works and always double-check the formulas. The flexibility comes at the price of possibly deleting or messing up an important formula, or making bad assumptions. In my opinion, the #1 problem associated with using a spreadsheet for your personal budget is the chance that you'll make errors. it's just a disclosure to say that I don't ONLY use Excel any more.Ī spreadsheet may not be the best budgeting solution for everybody.

Easy personal budget template excel download#

I started out using Excel to do everything, but I began using Quicken after a friend showed me how easy it was to keep track of checks and credit card charges and download transactions directly from my bank.

A budget is almost useless without tracking what you are spending. For expense tracking, you could use my Income and Expense Worksheet, Checkbook Register, or the newer Money Manager. Tracking your income and spending comes both before and after making a budget. For example, I like to use cell comments to explain certain budgeted items in more detail (such as the fact that in May, there is Mother's Day and a couple of birthdays to remember).Ĭreating a simple personal budget (even if it is only on paper) is one of the first steps to gaining control of your spending habits. The reason I use Excel when working with my home and business budgets is that it gives me complete flexibility to keep track of the information the way I want to.

If you don't own Excel, then Google Sheets and OpenOffice are free options to consider. Microsoft Excel isn't free, but if you already own Excel, then you can create a budget without purchasing other budgeting software. 42 Effective Ways to Save Money Budgeting Tips for the New Year Why Use Excel for your Personal Budget?įirst reason: it's free.

0 kommentar(er)

0 kommentar(er)